The Path to Wealth

Although money doesn’t grow on trees, it is possible to accumulate wealth with diligent effort and the right strategies. Building wealth is not just about earning more; it’s about making informed financial choices based on a solid formula you can consistently apply throughout your life.

Have you ever stopped to consider how quickly your money seems to disappear each month? Financial challenges are a reality for many individuals, often leaving them feeling financially cramped or relying on their next paycheck. To tackle these challenges effectively, adopting a proactive financial mindset is crucial. A relevant example comes from personal finance expert Dave Ramsey, who authored “The Total Money Makeover” and famously says, “You must live on a budget, not on a wish.” This advice underscores the significance of creating and adhering to a budget that prioritizes saving. By putting savings first, you can create a more secure financial future while ensuring that your spending aligns with your financial goals.

Prioritize Your Financial Well-Being

One practical step is to implement the principle of “paying yourself first.” Start by setting aside 5 to 10% of your monthly income in a dedicated savings account. Aim for a savings rate of 15% or more if your situation permits. Treat this saving as a non-negotiable expense—your “family financial bill.” By doing so, you actively prioritize your family’s financial future before addressing other costs. Consider this: your necessities, such as housing and food, should precede discretionary spending. For instance, paying for your cable TV subscription shouldn’t come before securing your family’s long-term financial wellness.

Invest in only what you truly need

Many individuals find themselves caught in a cycle of spending, where shopping becomes both a routine and a source of pleasure. It’s important to understand that simply finding bargains or buying items on sale doesn’t always translate to actual savings; often, these purchases can be impulse buys that do not meet genuine needs.

To promote better financial discipline, it’s essential to differentiate between your genuine needs and your wants. For instance, consider whether you truly need a new phone or if you’re simply drawn to the latest model because of its trendy features. This kind of reflection encourages more mindful spending habits. Additionally, think about your lifestyle choices: How often do you find yourself enticed by high-end dining experiences? You might plan for a casual meal at home, only to end up splurging on a gourmet restaurant. By regularly evaluating your spending motivations, you can cultivate a more thoughtful approach to your financial decisions.

Small Modifications, Significant Earnings

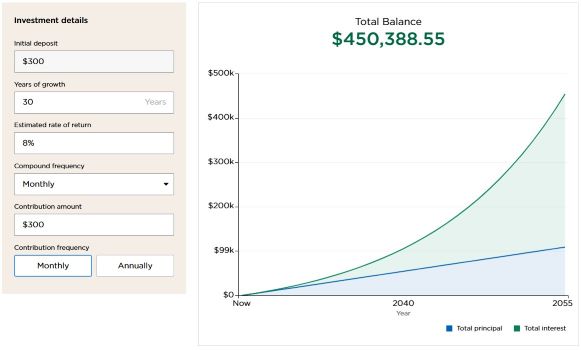

Understanding the impact of spending and saving habits is essential for achieving financial well-being. For instance, by reducing your daily expenditure by one expensive coffee, which typically costs around $5, you could save approximately $150 by the end of the month. If you then invest that $150 monthly at a compounding interest rate of 8% (see image below), consider the potential benefits of doubling that contribution. Making small, consistent changes to your daily spending can lead to significant financial improvements over time, enabling you to work towards a more secure financial future.

Now, think about the impact those savings could have on your future, particularly regarding retirement planning. Rather than feeling constrained by your current financial situation, consider specific areas where you can reduce expenses. For instance, evaluate your luxury items and services consumption: Could you cut back on premium coffee beverages, bottled water, or fancy dinners? Are there subscriptions that you no longer use, like cable TV or streaming services? Assessing these luxuries could yield significant savings.

Ultimately, it’s not just about how much money you earn; it’s about how much you retain and grow. Wealthy individuals often share the trait of being mindful and intentional about their spending habits. By incorporating these practices into your life, you can significantly improve your financial health and work actively toward achieving your short-term and long-term financial goals. Remember, building wealth is a journey that requires persistence and thoughtful decision-making.

Leave a comment