Life Insurance Myths Debunked: Can It Actually Benefit Young Adults?

When it comes to life insurance, young adults often navigate a landscape filled with misconceptions and uncertainty. Many mistakenly believe life insurance is necessary only for older individuals or those with families. However, debunking these myths reveals that life insurance can provide financial protection and peace of mind for young adults, regardless of their life stage or circumstances.

One of the most pervasive myths is that life insurance is only necessary for individuals with dependents, such as spouses or children. While it’s true that parents and caregivers often prioritize this coverage to shield their loved ones from financial hardship in the event of their untimely passing, young adults can still find immense value in securing a policy. For instance, let’s consider Angela, a 25-year-old recent college graduate with $30,000 in student loans. If an unexpected tragedy were to occur, a life insurance policy could help cover those debts, protecting her parents from being burdened with financial obligations. This proactive approach safeguards loved ones and helps young adults like Angela establish financial responsibility.

Another common belief is that life insurance premiums are prohibitively expensive for young adults. In reality, many insurance options are quite affordable, especially for individuals in good health. For example, a term life insurance policy offers coverage for a designated period—typically 10 to 30 years—at a lower cost than whole life insurance policies, which provide lifelong coverage and an investment component. By opting for term insurance while young and healthy, individuals can secure lower premiums now, making it easier to fit into their budgets. This is particularly beneficial for those just starting their careers who may not have substantial expendable income.

Additionally, some young people believe they do not need life insurance for many years. However, this mindset can be shortsighted. Life insurance can be an essential tool for building long-term financial security right from adulthood. Beyond providing for beneficiaries, specific policies like whole or universal life insurance allow policyholders to accumulate cash value over time. This cash value grows at a predetermined rate and can be accessed through loans or withdrawals for significant life expenses, such as purchasing a home, funding higher education, or starting a business. Thus, life insurance can be considered a multifaceted investment rather than merely a safety net.

One particularly beneficial aspect of specific life insurance policies is their life benefits, which can prove invaluable during the policyholder’s lifetime. Many modern life insurance products now include features that provide living benefits, allowing individuals to access a portion of their death benefit in cases of terminal, chronic, or critical illness. This means that if a young adult is diagnosed with a severe health condition, they can utilize these funds to cover medical costs or other financial needs, alleviating some of the stress of managing such a situation.

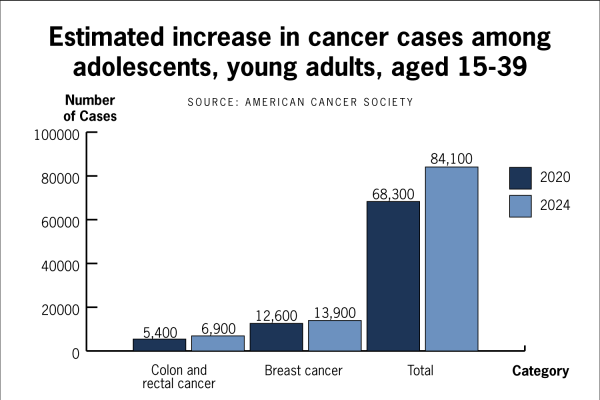

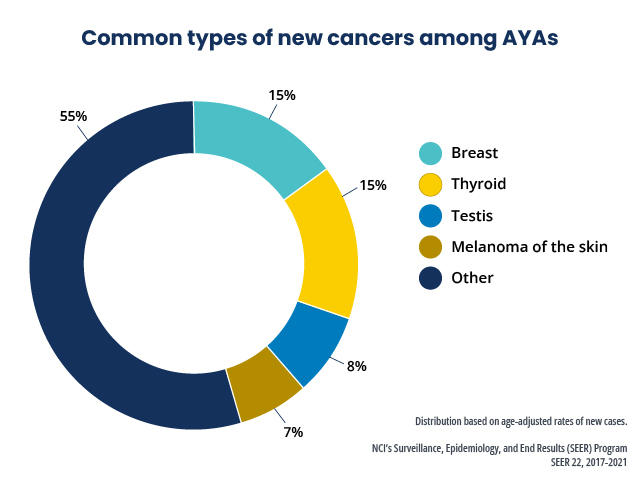

This is especially relevant considering that cancer rates among younger adults have been increasing. According to National Cancer Institute – “An estimated 84,100 adolescents and young adults (AYAs) between the ages of 15 to 39 will be diagnosed with cancer in the United States in 2024. This accounts for about 4.2% of all cancer diagnoses.” The added layer of security underscores the versatility and relevance of life insurance for young adults.

Source: https://www.cancer.gov/types/aya

Another myth that often deters young adults from exploring life insurance options is the perception that the product is too complicated to understand. While it’s true that the insurance world can be overwhelming, many insurance providers have made strides in simplifying their offerings. With user-friendly websites, online calculators, and educational resources, young adults can easily navigate the available options and understand their coverage needs. By dedicating time to research, individuals can make informed decisions aligning with their financial goals.

Finally, a significant misconception persists that life insurance is only relevant to those who have reached specific milestones in life—such as marriage or parenthood. In truth, life insurance can be a smart financial strategy for anyone, offering not just protection but a sense of financial confidence. Having a policy in place—even for those who are single or living independently—can offer relief against the uncertainties of life. It serves as a financial safety net and demonstrates a commitment to responsible financial planning.

In conclusion, life insurance is not just a product reserved for families with dependents. It can be an integral part of financial planning for young adults, providing them with essential protections and opportunities for growth. By debunking these common myths and acknowledging the benefits of living benefits, it becomes clear that investing in life insurance can ensure that financial burdens do not fall on loved ones while also fostering a secure financial future. Young adults who take the time to explore their options and understand the benefits of life insurance will find themselves empowered to make informed decisions that promote both peace of mind and financial security.

Leave a comment