Stay-at-Home Parents Absolutely Need Life Insurance

Stay-at-home parents should consider life insurance essential for their family’s financial security. Although they may not bring home a paycheck, their contributions are invaluable. According to the Pew Research Center, the estimated economic value of a stay-at-home parent’s work can often exceed a six-figure annual salary when accounting for their myriad tasks—cooking, cleaning, managing schedules, and providing daily care and education to children.

To illustrate, consider a scenario where a stay-at-home parent unexpectedly passes away. The working spouse would likely face overwhelming emotional distress along with immediate financial challenges. Childcare services may need to be employed, which can be prohibitively expensive, potentially draining savings or requiring the working spouse to cut back on work hours to compensate for the lost support at home. A life insurance policy can provide a safety net, allowing the family to transition through this challenging time without falling into financial instability. Coverage would offer crucial benefits that help maintain the family’s standard of living and provide for future needs, such as education costs for the children.

Do Single People Need Life Insurance? Yes, they do.

Single individuals often overlook the necessity of life insurance, but it can be equally vital for them. Many single people have significant financial responsibilities, including student loans, mortgages, and other debts. For example, a young professional with significant student loan debt may consider a life insurance policy to ensure their family is not burdened with repaying those loans should something happen to them.

Furthermore, life insurance can fulfill personal values and create a legacy. A single person might wish to support a charitable organization or a cause they care deeply about. For instance, if they took out a life insurance policy naming a charity as the beneficiary, their contributions could continue long after they’ve gone, which can be a fulfilling way to make a lasting impact.

A Guide to Effectively Obtaining Life Insurance

Many often feel overwhelmed by buying life insurance, viewing it as complex and confusing. However, it’s essential to know that it’s not as complicated as it seems. Essentially, purchasing life insurance is akin to buying other everyday products. Just like comparing prices and quality of items at the store, you can approach life insurance by examining its unit cost.

For instance:

| COST | UNIT | |

| Sugar | $1.00/$2.02 | pound/kilogram |

| Eggs | $3 | dozen |

| Gas | $5.00/$1.32 | gallon/liter |

| Gold | $1,800/$64.30 | ounce/gram |

| Movie | $15 | ticket |

| Life Insurance COI | $1,000 | Insurance |

When you decide to invest in life insurance, you choose a policy that suits your needs and budget, much like any other insurance or service. Each policy has a defined premium based on various factors, such as age, health, and desired coverage amount. By understanding these basic concepts, you can confidently navigate the life insurance landscape and make informed decisions that provide financial security for your loved ones.

The process of purchasing life insurance can be simplified into several key steps:

- Assess Your Needs: Evaluate your financial responsibilities, including any debts, dependents, and future financial goals. This assessment will guide you on how much coverage you need.

- Understand Policy Types: Research different life insurance policies, primarily focusing on term life insurance (which covers you for a specific period) versus whole life insurance (which offers lifelong coverage and a savings component). For example, a newly married couple intending to buy their first home may feel more secure opting for a 20-year level term policy to ensure that their mortgage is taken care of should anything happen.

- Gather Quotes: Use online tools to compare quotes from various insurance companies. After understanding what you need and which policy types best suit you, gathering several quotes can help you identify the most competitive rates. Many insurers offer instant quotes online, making it easier to gauge the cost of coverage.

- Consult an Expert: Consider engaging with an insurance broker or financial advisor, especially if you’re unsure about coverage amounts or which policy best fits your financial situation. They can provide personalized advice tailored to your circumstances.

- Complete the Application Process: Once you’ve chosen a policy, you’ll fill out an application that requires detailed personal and health information. This application may also involve a medical exam and underwriting process, where the insurer assesses risk and determines your premium.

Cost per $1,000 of coverage

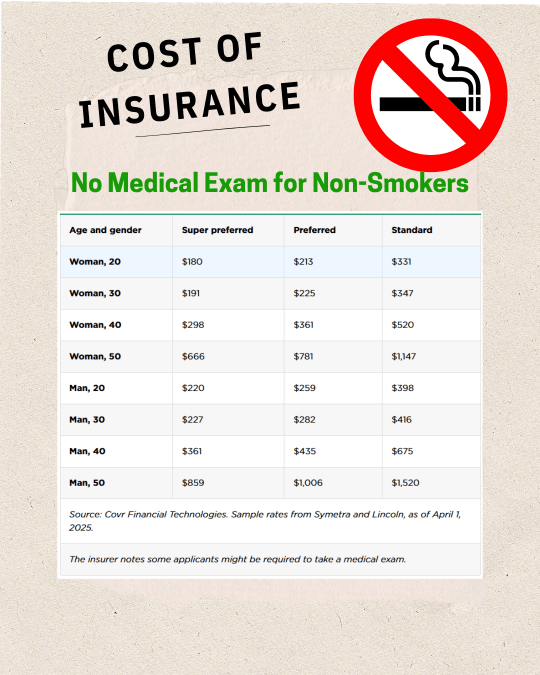

The cost of life insurance can vary significantly based on factors such as age, health status, gender, and the type of policy selected. A healthy individual in their 30s might expect to pay approximately $5 to $10 per $1,000 of coverage for a term life insurance policy.

For instance, consider a 20-year-old male non-smoker seeking a $500,000 policy. Their monthly premiums range from $25 to $50, a manageable cost considering the peace of mind and financial security it provides. Pricing can fluctuate significantly among providers, so shopping around and comparing rates is crucial.

Conclusion

In conclusion, the importance of life insurance cannot be overstated, regardless of one’s family situation. For stay-at-home parents, obtaining a life insurance policy is crucial for ensuring their families are financially protected. While their contributions may not always be reflected in a paycheck, their responsibilities are irreplaceable in maintaining a household’s stability. A sudden loss can leave the remaining partner not only grappling with grief but also facing additional financial pressures. Life insurance becomes a necessary safeguard to help alleviate these burdens.

Similarly, single individuals must recognize the significance of life insurance in their financial planning. Beyond addressing outstanding debts and financial obligations, life insurance can also be a way to leave a legacy and support causes that matter to them. By selecting beneficiaries wisely, single persons can continue to make an impact even after they are gone.

Navigating the life insurance landscape does not have to be overwhelming. By following a structured approach—assessing personal needs, understanding different policy types, gathering quotes, consulting with experts, and completing the application process—individuals can confidently select a policy that provides adequate coverage without compromising their financial well-being. Because costs vary based on individual circumstances, it is essential to research and compare options, ensuring that the chosen policy aligns with both current financial responsibilities and long-term goals.

By taking proactive steps to secure life insurance, whether as a caretaker at home or a solitary professional, individuals reinforce their commitment to their loved ones’ futures. Ultimately, life insurance is not just a financial product but a thoughtful investment in the continuity of care and support for those we cherish most.

Leave a comment